In recent years, the rise of mobile payments has been revolutionary, changing the way people transact with one another. Developing economies, in particular, have experienced rapid growth in alternative payment adoption, leapfrogging traditional payment methods such as credit and debit cards. According to a Grand View research, the global real-time payments market size was valued at USD 17.57 billion in 2022 and is expected to have a compound annual growth rate (CAGR) of 35.5% from 2023 to 2030. Let's delve into the phenomenon of RTP and explore its benefits for merchants.

Types of Real-Time Payment

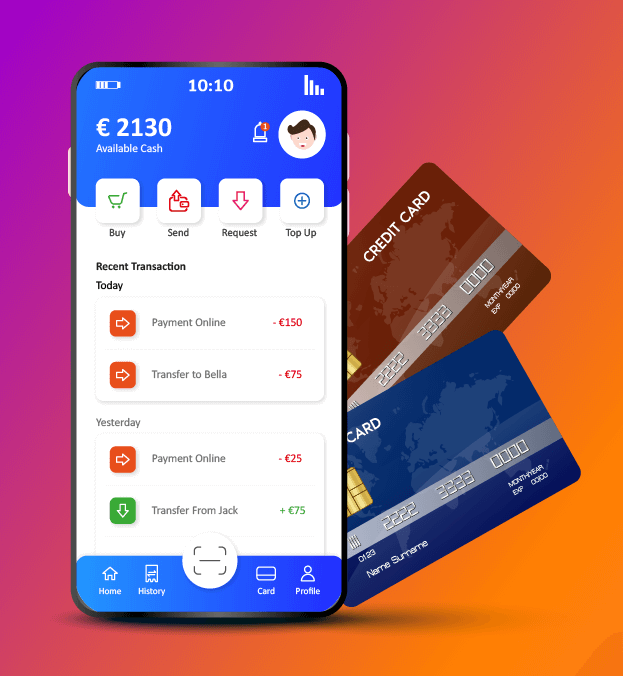

There are three major types of instant real-time payments. They are:

- E-Wallets

- Instant Bank Transfers that use account numbers.

- Real-time payment (RTP) transfers from one bank account to another using an alias or unique ID.

Benefits of Real-Time Payments

Real-time payments offer a range of benefits to companies using mobile wallets, including:

- Improved cash flow: Real-time payments provide immediate access to funds, allowing companies to manage their cash flow better and reduce the risk of late payments.

- Faster transactions: Real-time payments are processed instantly, reducing transaction times and improving the customer experience.

- Increased convenience: Real-time payments can be made from any location at any time, making them a convenient and accessible option for customers.

- Enhanced security: Real-time payments are highly secure, with advanced encryption and authentication technologies that help protect against fraud and unauthorized transactions.

- Lower costs: Real-time payments can reduce the cost of processing transactions with lower transaction fees and fewer chargebacks.

- Greater flexibility: Real-time payments can support a wide range of payment types and currencies, providing greater flexibility for businesses operating in global markets.

- Improved data management: Real-time payments provide detailed transaction data at the moment of occurrence, enabling businesses to manage their finances better and track their performance.

COVID-19 Role in Real-Time Payments

The COVID-19 pandemic brought about an unprecedented acceleration of the adoption of digital payments. Real-time payments became increasingly important, providing a faster, safer, and more convenient way for consumers to transact without the need for physical contact.

The pandemic forced companies to rely more heavily on mobile wallets and other forms of contactless payments to minimize the risk of transmitting the virus. Mobile wallets emerged as one of the most convenient and secure ways to pay for goods and services while reducing exposure to physical contact.

However, real-time payments also became a critical aspect of the COVID-19 response, as they allowed for quick and seamless transactions between businesses and consumers. As a result, companies that were already using mobile wallets had the opportunity to expand their business by incorporating real-time payments into their operations.

Only 14 countries in 2015 had real-time payment capability. Fifty-six nations, including the US, India, Singapore, Poland, etc., have enabled real-time payments, with New Zealand, Peru, Canada, Colombia, and Indonesia, following them and incorporating instant real-time payments in their lives.

One example of how COVID-19 impacted real-time payments is the use of instant payments to distribute government relief funds to citizens. In many countries, governments used real-time payment systems to provide financial assistance to individuals and businesses affected by the pandemic.

Real-time payments can also help businesses improve their cash flow and reduce operational costs. By processing payments in real time, companies can avoid delays in receiving payments and reduce the risk of fraud. Additionally, real-time payments can help businesses streamline their accounting processes and reduce the need for manual reconciliation of payments.

COVID-19 highlighted the importance of real-time payments in the new normal. Companies already using mobile wallets could utilize this trend by incorporating real-time payments into their operations. Doing so can improve their cash flow, reduce operational costs, and provide a more convenient and secure payment experience for their customers.

Conclusions

The increasing preference for real-time payments among several businesses is expected to boost their market growth. In fact, a press release by worldwide payment leader ACI Worldwide reported that nearly 80 percent of globally surveyed merchants believe that the use of payment cards would be replaced by real-time payments over time.

As technology continues to evolve, real-time payments will play an increasingly central role in the way businesses and consumers manage and move money, ultimately shaping the future of finance. Embracing this change and staying informed about its developments will be key to navigating the evolving financial landscape successfully.