Direct carrier billing (DCB) has been a transformative force in reshaping the digital services landscape, facilitating seamless transactions for various digital merchants, including app stores, console gaming, and audio & video streaming services. While DCB's growth to date has been remarkable, it's worth exploring whether we are standing on the edge of the next thrilling evolutionary phase.

What is carrier billing?

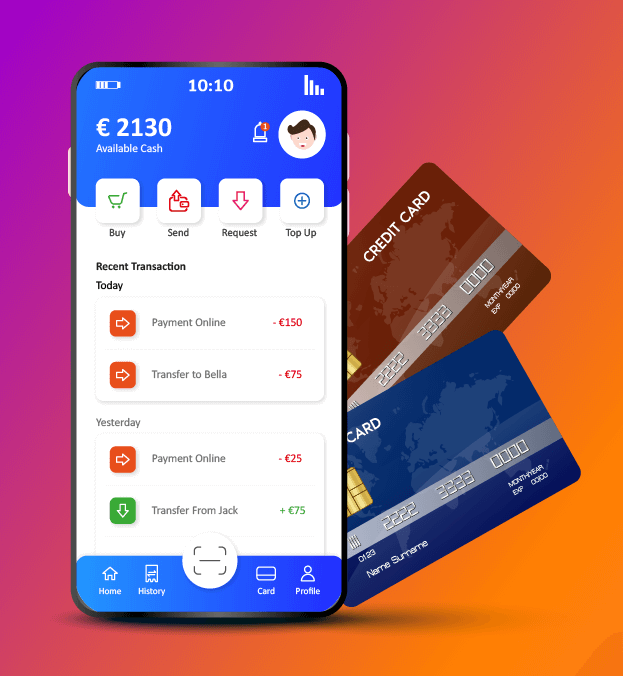

Direct carrier billing (DCB), also known as carrier billing, is a convenient mobile payment solution enabling users worldwide to seamlessly utilize their monthly mobile bill or pre-paid balance to make online purchases of digital services, without the hassle of prior registration or activation. It just works!

Originating from the rather simplistic PSMS services used more than a decade ago to purchase ringtones and wallpapers, DCB has matured into a sophisticated real-time payment mechanism. It now accommodates various transaction types including single charges, subscriptions, and tokenization, catering to diverse merchant needs.

Often overlooked is the fact that DCB is also one of the original BNPL (Buy Now, Pay Later) payment services, giving post-paid subscribers up to a months effective credit when making purchases.

The journey of carrier billing so far and the role of Boku in getting DCB to where it is today

DCB is often perceived as a universally accessible alternative payment method. However, in reality it serves as an umbrella term encompassing a diverse array of local payment methods provided by Mobile Network Operators (MNOs). From its founding, in 2009, Boku took the lead in harmonizing these methods by crafting a standardized framework specifically designed to meet the needs of global merchant within the digital economy. This predates the more recent initiation of CAMARA, an open-source project within the Linux Foundation working closely with the GSMA Operator Platform Group, which started working on a standard for Carrier Billing Check Out.

Shaping the future of DCB

We highlight below three factors that are shaping the future of DCB

- Regulatory Dynamics: In various markets, the success of Direct Carrier Billing (DCB) is intricately tied to regulatory factors. Notably, in the European Union, PSD II exceptions have played a significant role in shaping the use of DCB for digital services. While certain limitations exist to manage risks, these regulatory adaptations aim to strike a delicate balance between fostering growth and ensuring security. The imminent PSD 3 adds an intriguing layer to the landscape, as ongoing debates surrounding the proposed revisions of Directive 2366/2015/EU (PSD 2) intensify. Although the precise impact on DCB remains uncertain, it is undeniable that the evolving PSD framework will continue to shape the future trajectory of DCB.

- Target Audience Dynamics: Understanding the diverse needs of our audience is crucial. In markets where multiple payment methods are available, the promotion of DCB's advantages requires strategic marketing efforts. The focus shifts from mere adoption to creating awareness and emphasizing the convenience that DCB offers.

- Piloting Beyond Digital Services: While digital services have warmly embraced DCB, expanding into non-digital services such as transportation and parking has presented challenges, but it's also an opportunity to learn and adapt. Consumer habits, regulatory considerations, and targeted marketing strategies all contribute to a holistic approach aimed at expanding DCB's footprint.

The Next Evolution - Boku's Visionary Agency Model

Boku, is introducing an agency model in various EU markets that has the potential to unlock accelerated growth for DCB This innovative approach aims to elevate DCB into a regulated payment method, potentially surmounting existing regulatory constraints. Initial market focus on console gaming anticipates an increase in transaction sizes, signaling a promising uptick in total processed volume (TPV) ranging from 15% to 100%, depending on the service.

Conclusion

While growth in digital service sectors may be slowing, because of regulatory constraints, the introduction of Boku's agency model heralds a new era for DCB. Overcoming regulatory challenges for existing services and expanding into non-digital services holds the promise of increased growth and relevance as a mainstream payment method.

Exciting times lie ahead for the continued evolution of Direct Carrier Billing!

Popular articles

No items found.

.jpg)